As we jump into spring, historically we see an increase in homes available for sale. Coming off the lowest months of inventory to date, this would be welcomed by eager home buyers as interest rates also continue to rise. Beyond the seasonal uptick in listings, there’s a chance we may see a wave of new builds on the horizon as well.

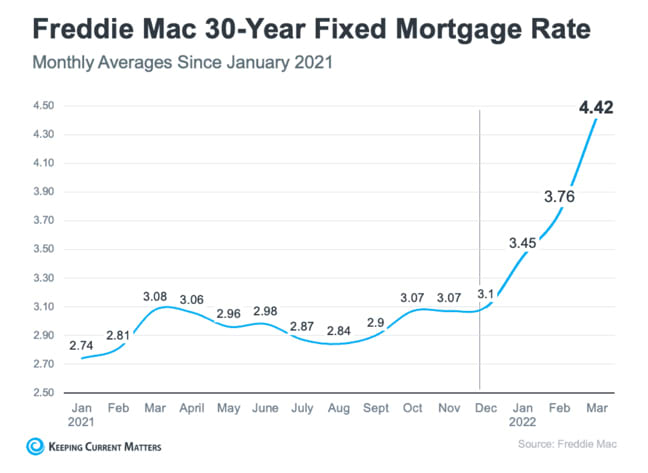

Before we take a look at inventory, let’s quickly revisit mortgage rates and home prices. As you know, they both continue to climb, but to what extent? 30-year fixed rates are about 1.5% - 1.75% higher than in January, sitting between 4.875% and 5.25%. In comparison, throughout 2021 rates were somewhat steady, but now we’re finally seeing spikes with the help of rising inflation, geopolitical uncertainty, and actions from the Fed.

Where are mortgage rates headed through the rest of the year? The National Association of Realtors’ Senior Economist and Director of Forecasting Nadia Evangelou says, “While higher short-term interest rates will push up mortgage rates, I expect some of this impact to be mitigated eventually through lower inflation. Thus, I expect the 30-year fixed mortgage rate to continue to rise, although we aren’t likely to see the big jumps that occurred over the past few weeks.”

On top of increased mortgage rates, Colorado saw an average of 20% appreciation last year. While prices continue to rise, this also means big equity gains for homeowners. If you’ve been waiting for the right time to buy, this may be the perfect time to make a move. Locking in a (still historically) low mortgage rate is a no-brainer, but let’s not forget the shortage of homes. Spring is the time of year when we usually see listings come back into the market, but a new build may also be a great option. Housing permits in the Denver Metro grew 16% in 2021 according to census figures, the highest rate in five years.

While 5.00% doesn’t sound as nice as the sub-3% rates we saw over the past year, let’s look at an example that demonstrates why it’s still a great time to buy, and why waiting will cost you. Say you purchased a $400,000 home today. With 10% down, you’d have a $360,000 mortgage at 5.00%, resulting in monthly payments of $1,932 (not including homeowners insurance, taxes, private mortgage insurance, or other fees as they vary based on location). Let’s say appreciation ends up at just 10% for 2022, even then your home would be valued around $440,000 in just one year. If you divide that $40,000 increase in equity over 12 months, that’s about $3,333/month, which is over $1000 more than your monthly payment.

If you’re ready to buy, waiting will only cost you. I have a number of programs to help you lock in your dream home, two of which are perfect for our current market: 8z Cash Buyer, allowing you to submit an all-cash offer, and 8z Modern Bridge, which allows you to buy and move into your new home before selling your current home. Give me a call today!